Check out our post with the most recent Lake County Market Update!

➡️ Is the housing market going to crash?

➡️ What’s happening with mortgage rates, now and in the future?

➡️ If the economy slows further, what does it mean for real estate?

➡️ What’s ahead for home prices?

➡️ Should I wait to buy a home?

Is the housing market going to crash?

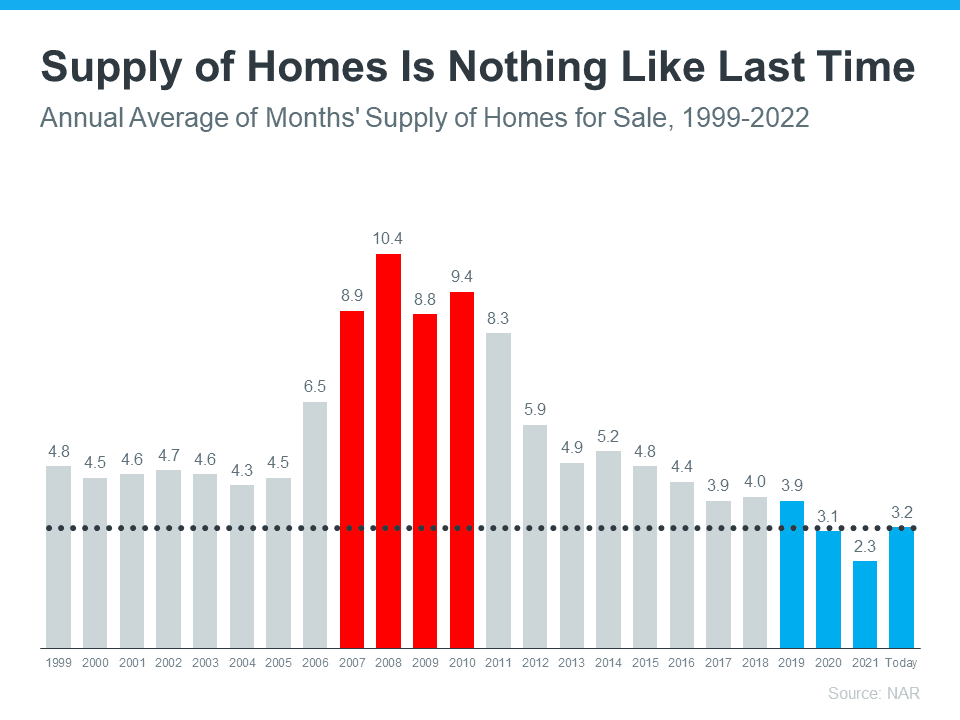

With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008.

The good news is, there’s concrete data to show why this is nothing like last time.

If you’re concerned we’re making the same mistakes that led to the housing crash, this graph should help alleviate your fears.

There just isn’t enough inventory on the market for home prices to come crashing down like they did the last time, even though some overheated markets may experience slight declines.

What’s happening with mortgage rates, now and in the future?

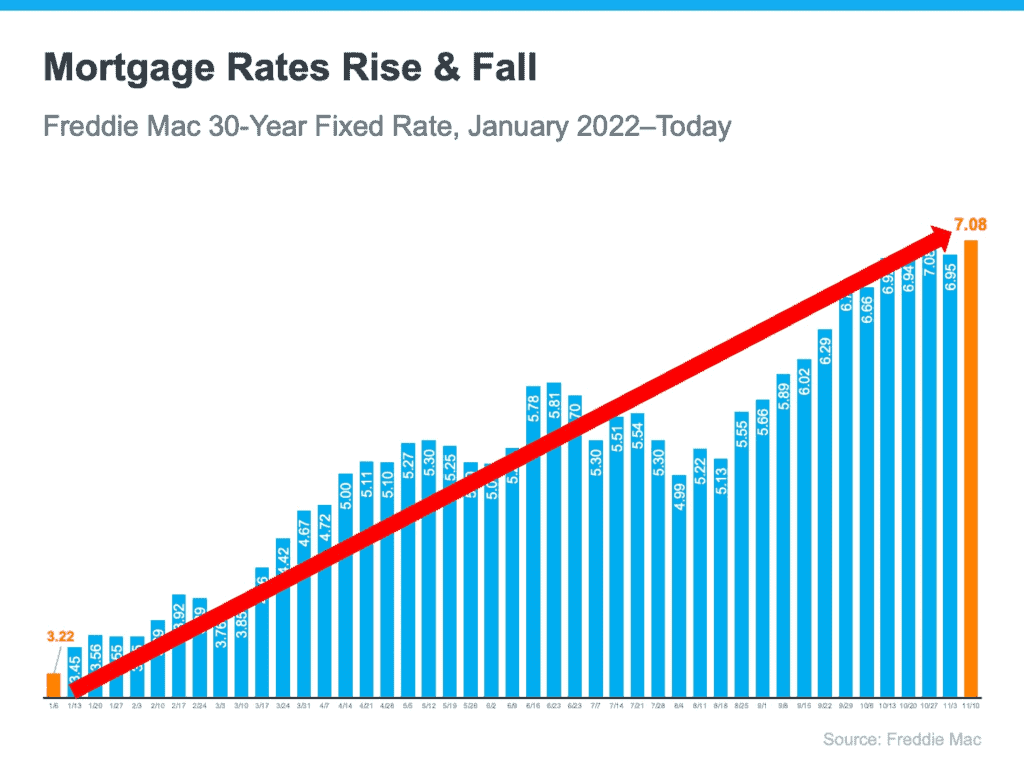

One of the biggest factors of the housing market cooldown we’re seeing is the swift rise in mortgage rates. And as that volatility continues, many people are asking “are mortgage rates going to keep rising?”

But to answer this question, you have to first understand the why behind the reason mortgage rates have doubled since the beginning of the year: inflation.

In an effort to ease inflation, the Federal Reserve is taking steps to try to tame inflation by slowing the economy, and those decisions are having an impact on mortgage rates. And until that’s under control, rates will continue to respond to inflation. If inflation eases, rates may as well.

If you’re waiting for mortgage rates to drop, you may be waiting for a while as the Federal Reserve works to get inflation under control.

And if you’re considering renting as your alternative while you wait it out, remember that’s going to get more expensive with time too.

Each person’s situation is unique. To make the best decision for you, let’s connect to explore your options.

If the economy slows further, what does that mean for real estate?

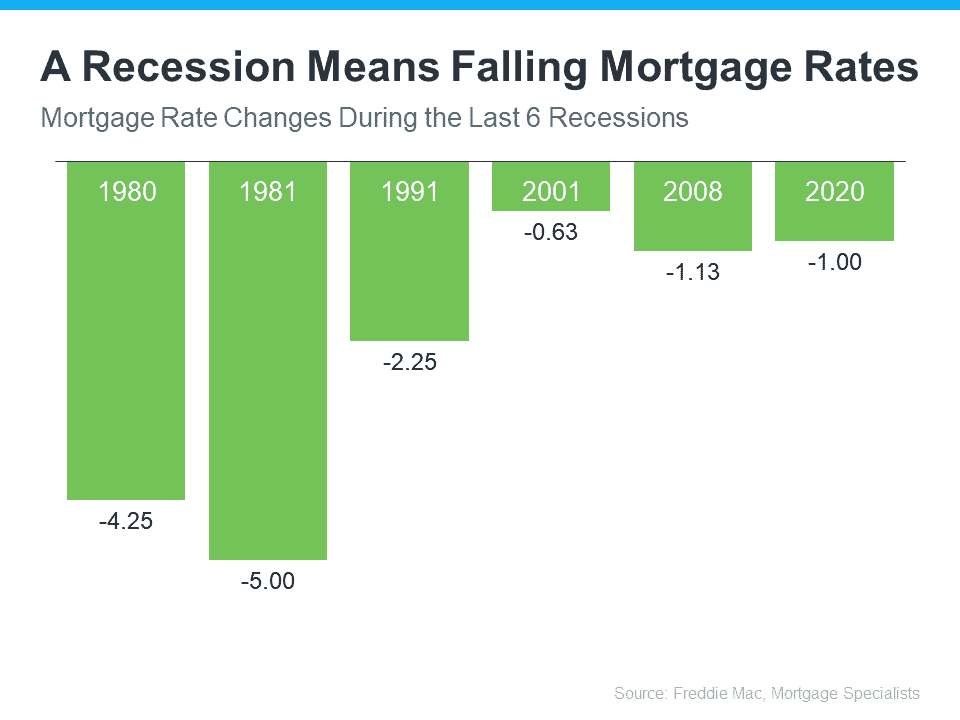

Post-2009, nothing will strike fear into the hearts of buyers and sellers like the word “recession.”

But as the economy slows down, history tells us this would likely mean lower mortgage rates for those looking to refinance or buy a home.

While no one really knows exactly what the future holds, one thing will forever remain the same: people will always need a place to call home.

Historically, each time the economy slowed down, mortgage rates decreased.

And while history doesn’t always repeat itself, we can learn from it. While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

What’s ahead for home prices?

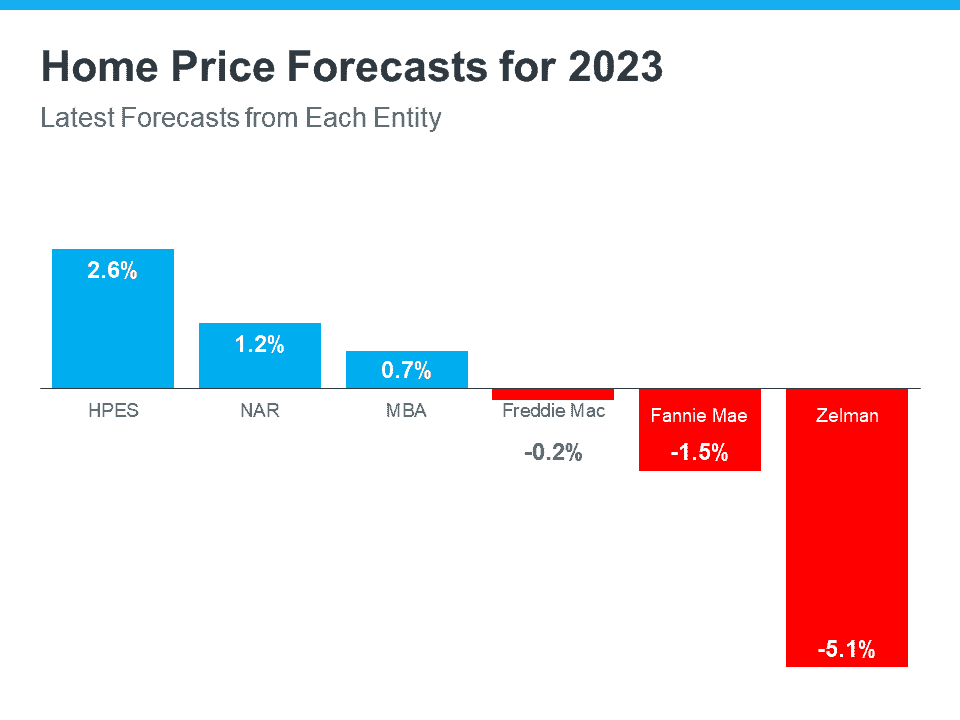

After years of record-breaking price appreciation in the country, we’ve been seeing a very different scenario play out in the last few months.

In order to truly understand why this is happening, this quote from David Ramsey explains it all:

“The root issue of what drives house prices almost always is supply and demand.”

As the housing market cools in response to the dramatic rise in mortgage rates, home appreciation is cooling as well. And if you’re following along with headlines in the media, you’re seeing conflicting messaging.

The most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation.

Should I wait to buy a home?

This is probably one of the biggest questions we’re getting asked right now.

Despite the volatility we’re seeing in today’s housing market, it’s important to remember there are many financial and non-financial benefits of homeownership.

Yes, affordability is a challenge right now. It’s true that it costs more to buy a home today than it did last year, but the same is also true for renting. This means, either way, you’re going to be paying more. The difference is, with homeownership you’re also gaining equity which will help grow your net worth.

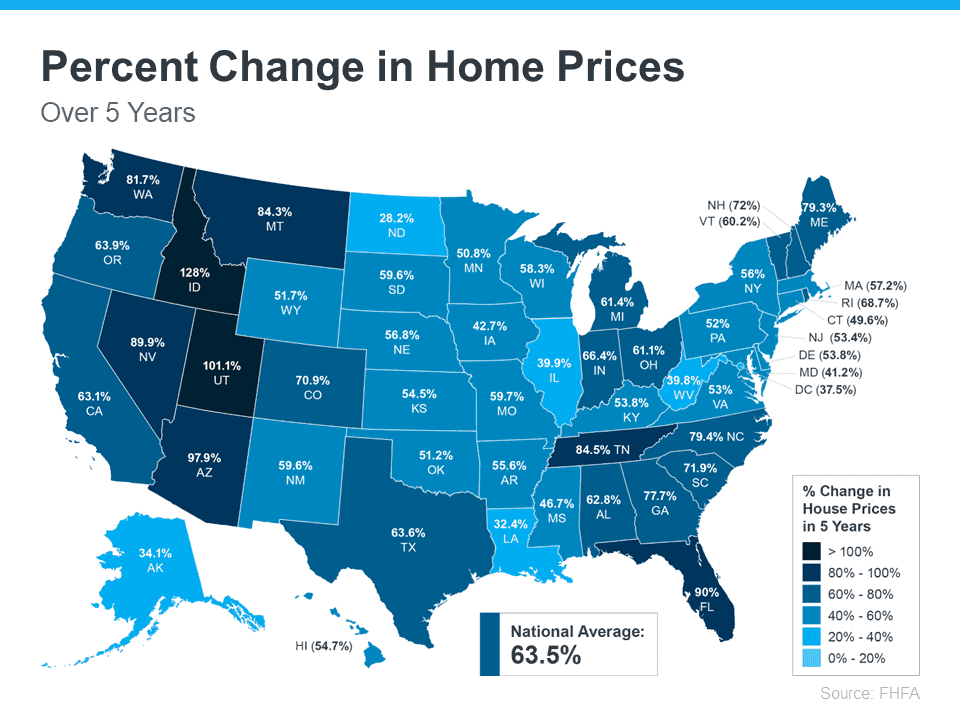

Wondering if you should buy a home today? Data shows home values typically appreciate over time, and that gives your net worth a nice boost.

Homeownership truly wins over time.

How can we help with your real estate dreams?